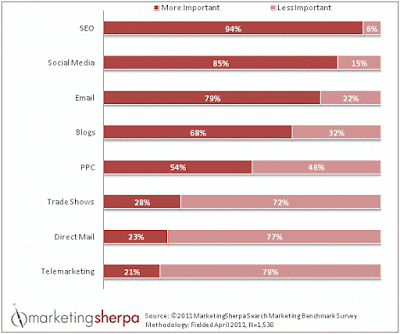

The fine folks at MarketingSherpa released a new report on inbound marketing and surprise, surprise inbound marketing if effective.

Leads obtained from inbound marketing tactics, such as SEO, social media and blogs, have increased in importance over the last 12 months, particularly when compared to leads from outbound marketing programs. Inbound marketing tactics tend to be cost-effective, and offer an efficient option for generating highly qualified leads.

Twelve Facts That May Surprise You About the Housing Bust - Nick Timiraos, WSJ

A new paper was released by the Federal Reserve that analyzed the housing bubble/crash. Their viewpoint is that the commonly accepted reasons for the bubble aren't really true. Agree?

Fact 1: Resets of adjustable-rate mortgages did not cause the foreclosure crisis.

Fact 2: No mortgage was “designed to fail.”

Fact 3: There was little innovation in mortgage markets in the 2000s.

Fact 4: Government policy toward the mortgage market did not change much from 1990 to 2005.

Fact 5: The originate-to-distribute model was not new.

Fact 6: MBS, CDOs, and other “complex financial products” had been widely used for decades.

Fact 7: Mortgage investors had lots of information.

Fact 8: Investors understood the risks.

Fact 9: Investors were optimistic about house prices.

Fact 10: Mortgage market insiders were the biggest losers.

Fact 11: Mortgage market outsiders were the biggest winners.

Fact 12: Top-rated bonds backed by mortgages did not turn out to be “toxic.” Top-rated bonds in collateralized debt obligations (CDOs) did.

No comments:

Post a Comment